Top Developer Confirms: Dubai’s Property Market Is Still Rising Into 2026

Despite recurring headlines predicting a slowdown, Dubai’s property market continues to demonstrate resilience and upward momentum. This confidence was publicly reinforced by Muhammad Binghatti, CEO of Binghatti Developers, who confirmed in September 2025 that Dubai real estate remains firmly on a growth trajectory, with no signs of an imminent downturn.

Rather than overheating, the market is transitioning from rapid acceleration into a more mature, structurally balanced growth phase. For long-term investors, this shift signals sustainability rather than risk.

Key Confirmation From a Leading Developer

Speaking on international media platforms, Muhammad Binghatti highlighted that Dubai’s real estate growth is being driven by genuine demand, strong transaction volumes, and a consistent pace of construction and delivery.

While external analysts continue to warn of a potential slowdown, Binghatti stated clearly that on-the-ground data tells a different story: projects are selling, handovers are accelerating, and buyer demand remains broad-based.

Dubai Property Market Performance: 2025–Early 2026

Market-wide performance metrics support this confidence. Dubai recorded one of its strongest real estate years on record in 2025, followed by continued stability into early 2026.

| Metric | 2025–2026 Data |

|---|---|

| Total Sales Value (2025) | AED 540+ billion |

| Total Transactions (2025) | ~200,000 deals |

| Transaction Growth (H1 2025 YoY) | +25% (AED 431 billion) |

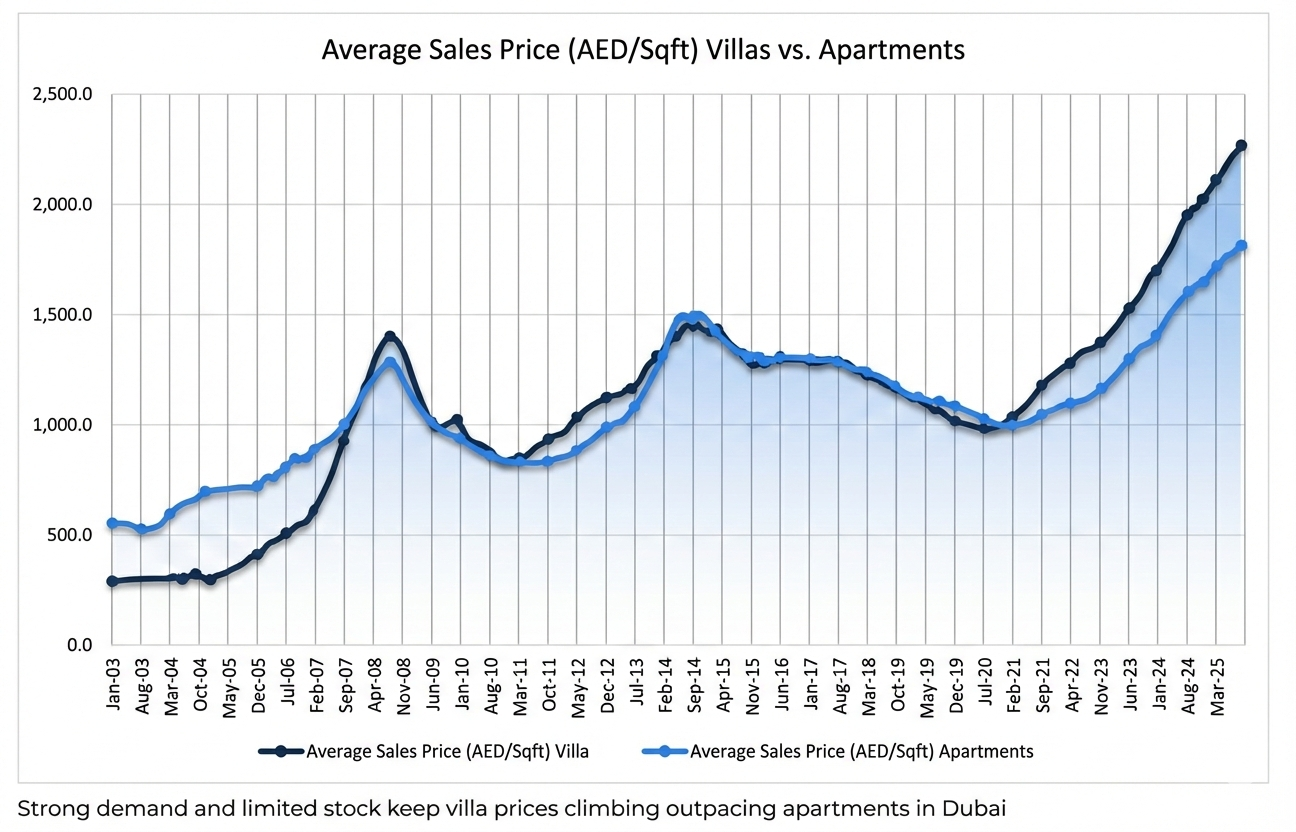

| Price Growth (2025) | ~12% to 17% |

| Price Forecast (2026) | ~4% to 7% (moderated growth) |

| Average Rental Yields | Apartments: 7–7.2% | Villas: ~5% |

Binghatti Developers: A Market Barometer

Binghatti Developers’ own performance reflects the broader market strength. In the first half of 2025 alone, the company delivered five of the 24 projects handed over across the entire Dubai market, accounting for approximately 20% of all handovers.

Financially, the company reported a 96% surge in net profits for 2025, with revenues nearly doubling year-on-year. Such performance is not characteristic of a market nearing collapse.

Further reinforcing confidence, Binghatti has aggressively acquired land for future developments, including a AED 25 billion master development in the Meydan district, signaling long-term commitment rather than short-term speculation.

Who Is Driving Demand?

One of the most important insights shared by Binghatti is the changing buyer profile. Demand is increasingly international and defensive in nature.

Buyers from countries experiencing currency volatility — including Turkey, Egypt, and parts of Eastern Europe — are entering Dubai real estate as a hedge against depreciation and capital controls. Dubai’s regulatory stability, currency peg, and asset-backed market make it a preferred store of value.

This type of capital is typically long-term and less speculative, strengthening market foundations.

A “Two-Engine” Market: Luxury and Affordable Segments

Dubai’s real estate market is best described as a two-engine system. Both luxury and affordable segments are performing simultaneously, which indicates structural health rather than a narrow speculative boom.

- Luxury & Branded Residences: Prime locations such as Palm Jumeirah and Dubai Hills Estate saw villa prices rise over 25% in 2025. Branded residences command premiums of 30–40% over non-branded stock.

- Mid-Market Hubs: Areas like Jumeirah Village Circle (JVC) and Business Bay remain the most active by transaction volume, driven by affordability, rental demand, and flexible payment plans.

Off-Plan Sales and Supply Dynamics

Off-plan sales continue to dominate the market, accounting for nearly 70% of all transactions in 2025. Flexible payment plans and developer incentives remain key drivers.

Approximately 120,000 new units are projected for delivery in 2026. However, historical patterns suggest actual handovers are likely to be lower due to phased construction and delays, reducing immediate oversupply risk.

Importantly, supply pressure remains concentrated in specific mid-tier apartment segments rather than across the entire market.

Structural Growth Drivers Supporting 2026

Several long-term fundamentals continue to support Dubai’s property market:

- Dubai’s population surpassed 4 million in 2025, driving sustained housing demand.

- Golden Visa and long-term residency programs continue to attract HNWIs and skilled professionals.

- Tax efficiency, geopolitical neutrality, and capital mobility reinforce Dubai’s safe-haven status.

- Infrastructure initiatives such as the Dubai 2040 Urban Master Plan and the Metro Blue Line are expected to unlock new growth corridors.

- Digital transformation, including tokenisation and blockchain-based property trading, is broadening investor access.

Risks to Watch — Without Overreacting

As with any mature market, risks exist. Analysts continue to monitor global economic volatility, interest rate movements, and potential oversupply in select mid-market locations.

However, these risks point toward moderation, not collapse. The current phase reflects a transition from explosive growth to sustainable expansion.

Investor Takeaway

Dubai’s property market is not slowing because demand is weakening. It is stabilising because it has matured. Developer confidence, delivery data, population growth, and capital inflows all confirm that the market remains fundamentally strong.

For investors, 2026 is shaping up to be a year of selectivity rather than speculation — rewarding those who focus on quality assets, strong locations, and credible developers.

In short, Dubai real estate is still rising — just on a healthier, more sustainable path.