Damac’s Revenue Backlog Surges to $20 Billion as S&P Upgrades Rating to ‘BB+’

Damac Properties, one of Dubai’s leading private developers, has strengthened its position in the market with S&P Global Ratings upgrading its long-term issuer and issue ratings to ‘BB+’ from ‘BB’. The upgrade reflects the company’s growing revenue backlog, strong cash flow visibility, and conservative financial policy amid continued momentum in Dubai’s residential real estate sector.

Strong Revenue Backlog and Presales

As of September 30, 2025, Damac’s revenue backlog reached $20 billion, up from $18 billion at the end of 2024. The company has already presold between 70% and 80% of its projects, providing solid revenue visibility for the next two to three years. According to S&P, Damac’s sales and presales performance demonstrates the enduring demand for residential property in Dubai, with approximately $6 billion in bookings from ongoing and new developments through Q3 2025.

Damac’s development pipeline includes more than 54,000 residential units, with delivery of about 1,000 homes expected in 2025 and 4,000 to 6,000 units annually between 2026 and 2027. Over 90% of revenue recognized during 2025–2026 is projected to come from already sold properties, ensuring predictable cash flow and financial resilience.

Strong Market and Financial Outlook

Dubai’s residential real estate sector remains robust, supported by high rental yields and strong foreign demand. Although S&P expects growth to moderate slightly in 2026 due to increased supply, the market fundamentals remain favorable. Off-plan transactions rose 39% year-on-year during the first nine months of 2025, while prices per square foot increased 5% for new developments, highlighting investor confidence in Dubai’s long-term potential.

S&P forecasts that Damac’s revenue will rise to between $4.0 billion and $4.3 billion in 2025, and further to $5.0 billion–$5.3 billion in 2026, up from $3.3 billion in 2024. The company’s EBITDA is expected to reach $1.2–$1.3 billion in 2025 and up to $1.7 billion by 2026, maintaining an adjusted debt-to-EBITDA ratio below 1.5x—well within S&P’s stability threshold.

Cash Flow and Liquidity

Operating cash flow is projected to remain strong, estimated between $2.0 and $2.7 billion during 2025–2026. Damac’s financial flexibility is further supported by $6.7 billion in cash reserves, of which about $5.7 billion is held in escrow accounts. Despite ongoing investments in land acquisition and new projects, the company maintains prudent liquidity management and a disciplined approach to leverage.

S&P expects Damac to continue diversifying revenue streams by increasing its investment in rental and commercial assets, such as malls and office properties. Although these segments currently make a limited contribution to EBITDA, they are expected to provide stable recurring income in the long term.

Dividend Policy and Financial Discipline

In line with its conservative financial policy, Damac plans to maintain balanced dividend distributions, estimated between $900 million and $1 billion in 2025 and up to $1.6 billion in 2026. These payouts are supported by the company’s solid cash position and steady escrow releases as projects reach completion milestones. The developer’s commitment to responsible capital management and debt repayment remains a key factor behind S&P’s positive outlook.

Moderating Growth but Stable Outlook

While the wider Dubai property market may see moderated price growth over the next 12–24 months due to a growing off-plan pipeline, analysts believe that a strong demand base, limited leverage, and controlled delivery schedules will sustain market stability. Damac’s strategic focus on brand strength, presales visibility, and liquidity discipline positions it as one of Dubai’s most resilient developers after Emaar Properties.

S&P’s stable outlook for Damac reflects confidence that the company will maintain its market position, continue strong presales performance, and preserve leverage metrics below 1.5x through 2026. Although the rating agency does not expect another upgrade soon, it emphasized that Damac’s disciplined operations, strategic diversification, and robust cash flow will continue to support its financial stability and creditworthiness.

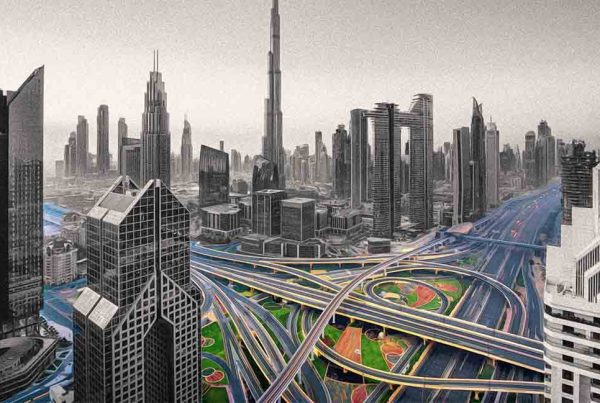

About Dubai’s Real Estate Landscape

The broader market in Dubai remains a magnet for international investors, benefiting from transparency reforms, favorable tax policies, and long-term visa incentives. Leading developers such as Damac and Emaar continue to drive growth across emerging communities like Business Bay, Dubai Marina, and Damac Hills, reinforcing Dubai’s global standing as a premier real estate investment destination.