Dubai Real Estate Ends 2025 at Record Highs, Setting a Strong Base for 2026

Dubai’s property sector closed 2025 with a December surge that pushed the market to new all-time annual records. Total sales reached 215,700 transactions worth AED 686.8 billion, reinforcing Dubai’s status as one of the most active and liquid real estate markets globally. December alone sustained that momentum, with monthly sales value rising 46.4% year-on-year to AED 63.1 billion, while transaction volume increased 21.3% to 18,587 deals.

Market data compiled through DXBInteract and referenced in an in-depth report by fäm Properties shows that the growth was not limited to a single segment. Primary and secondary markets both expanded meaningfully, supported by broad demand, rising price points, and an active development pipeline. Heading into 2026, this matters because it signals a market that is responding to real absorption rather than speculation alone.

The Core Numbers That Defined 2025

The headline results from 2025 show clear, measurable expansion compared to 2024. Transaction volumes rose 18.7% to 215,700 sales, while total sales value climbed 30.9% to AED 686.8 billion. These figures point to both higher activity and higher ticket sizes, which is a crucial indicator of market depth.

Primary market performance remained dominant. First sales totalled 149,230 transactions valued at AED 448.1 billion, representing 33.6% year-on-year growth. The secondary market also expanded, recording 66,400 resale transactions worth AED 238.8 billion, up 26.2% year-on-year.

Prices Moved Higher, But Liquidity Stayed Strong

Price appreciation was evident across both markets. Average price per square foot reached AED 1,700 in the primary market, a 6.7% increase, while the secondary market rose faster to AED 1,500 per square foot, up 11.2%. When resale values rise faster than off-plan averages, it often reflects strengthening end-user demand and a growing preference for ready, usable stock in established communities.

The key point is that higher prices did not slow transaction flow. Both entry and exit liquidity remained active, suggesting that buyers were still confident in their ability to transact efficiently in both new launches and the resale market.

Supply Responded, and the Pipeline Stayed Busy

2025 also showed that Dubai’s supply engine is expanding in parallel with demand. A total of 42,784 properties were delivered during the year, up 45% from 29,392 units in 2024. At the same time, developers launched 177,624 new units, up 6.1% from 167,408 in 2024.

This balance is important because it supports the idea of market maturity. When deliveries rise sharply yet transactions continue to set records, it suggests absorption is keeping pace and that supply is increasingly aligned with the market’s real needs.

Five Years of Growth Show a Structural Shift

Dubai’s 2025 performance also looks different when viewed against the last five years. Sales value increased from AED 71.5 billion in 2020 to AED 686.8 billion in 2025. Transaction volumes grew from 34,700 deals to 215,700 over the same period. That kind of jump is not simply a short-term spike. It reflects a market that has broadened its global buyer base, strengthened its transaction infrastructure, and developed deeper confidence across investor categories.

Demand Was Broad, Not Concentrated in One Asset Class

One of the strongest signals from 2025 is that growth did not rely on a single property type. Apartment sales rose 19.9% to 170,448 transactions, valued at AED 332.9 billion. Villa sales increased 11.1% to 34,671 units worth AED 206.9 billion.

Commercial real estate showed particularly strong momentum, with transactions surging 41.1% to 6,086 deals totalling AED 18.2 billion. Plot sales reached 4,446 transactions with a combined value of AED 128.5 billion, while building sales rose sharply by 306.3% to 65 units valued at AED 211.9 million. Together, these figures confirm that activity remained multi-dimensional, reflecting both residential demand and real-economy expansion.

Off-Plan Continued to Lead, Highlighting Confidence in New Supply

First sales accounted for 69% of transaction volume versus 31% for resales, and 65% of total value compared to 35% in the secondary market. This matters because it shows that market participants are still willing to commit capital to future supply, which typically requires confidence in delivery timelines, developer credibility, and long-term positioning.

Where Deliveries Clustered in 2025

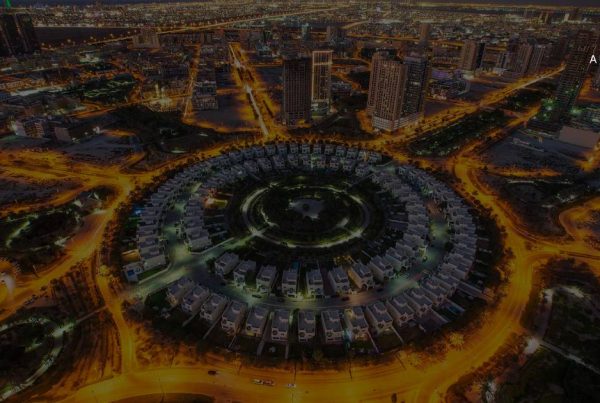

The highest concentration of delivered units occurred in Jumeirah Village Circle with 6,883 units, followed by Dubai Marina with 3,819, Business Bay with 3,103, Arjan with 2,510, and Dubai Creek Harbour with 1,919. These delivery hotspots reflect where development has scaled most aggressively, and they are also the areas where investors will need to be more selective in 2026 as competition within sub-markets increases.

Developer Delivery Leaders

Developer output reflected the same momentum. Emaar led annual deliveries with 7,321 units, representing 17% of delivered supply. Binghatti followed with 4,093 units, around 10%, and Azizi delivered 2,633 units, around 6%. Strong delivery performance from major names typically supports confidence in execution, especially in an environment where buyers increasingly prioritise track record and construction consistency.

Ultra-Prime Demand Stayed Strong at the Top End

At the highest end of the market, demand remained clearly intact. The most expensive transactions of 2025 included an AED 550 million apartment at Bugatti Residences by Binghatti in Business Bay and an AED 425 million villa in Emirates Hills. These deals do more than create headlines. They also set pricing ceilings that often reinforce value perception across premium sub-markets.

Top Performing Areas and Best Selling Projects

In terms of area performance by sales activity, Jumeirah Village Circle recorded 18,755 transactions worth AED 24.5 billion. Business Bay posted 13,844 deals worth AED 39.9 billion. Wadi Al Safa 5 saw 11,631 transactions worth AED 21.8 billion. Dubai South recorded 10,025 deals worth AED 25.3 billion. Jebel Ali 1st posted 8,263 deals worth AED 18.3 billion.

On the project level, first-sale apartment demand was led by DAMAC Riverside with 3,706 transactions worth AED 4.8 billion and a median price of AED 1.2 million, followed by Binghatti Skyrise with 2,653 transactions worth AED 4.2 billion and a median price of AED 1.4 million. Sobha Solis recorded 2,064 deals worth AED 2.5 billion, Sobha Orbis delivered 1,518 deals worth AED 2.0 billion, and Binghatti Flare posted 1,196 deals worth AED 1.5 billion.

For first-sale villas, DAMAC Islands Maldives led with 1,547 transactions worth AED 5.9 billion and a median price of AED 2.6 million. DAMAC Islands Bali followed with 1,073 transactions worth AED 3.0 billion and a median price of AED 2.5 million. Dubai Investment Park Second posted 1,071 transactions worth AED 4.2 billion with a median of AED 3.6 million. DAMAC Islands Bora Bora recorded 900 transactions worth AED 1.7 billion, and Reportage Village 1 posted 706 transactions worth AED 951.2 million.

Resale apartments were led by Azizi Riviera with 1,119 transactions worth AED 954.4 million and a median price of AED 693.5K. Mediterranean Cluster recorded 445 transactions worth AED 283.0 million, Elite Sports Residence posted 399 deals worth AED 240.7 million, Skycourts Towers recorded 369 transactions worth AED 225.9 million, while Sobha Hartland The Crest saw 369 transactions worth AED 740.3 million with a higher median of AED 1.7 million.

Resale villas saw DAMAC Islands Bora Bora leading with 396 transactions worth AED 1.2 billion and a median of AED 2.5 million. Al Furjan recorded 377 deals worth AED 2.0 billion with a median of AED 4.9 million. DAMAC Islands Maldives posted 307 transactions worth AED 846.2 million, Rukan 3 recorded 240 transactions worth AED 322.5 million, and Jumeirah Village Triangle posted 175 transactions worth AED 729.3 million with a median of AED 4.6 million.

Conclusion: 2025 Was Not Just Growth, It Was Proof of Market Depth

Dubai’s 2025 real estate results point to a market that has evolved beyond momentum-driven expansion. Record volumes and values, strong primary and secondary performance, a sharp increase in deliveries, and continued ultra-prime demand together suggest depth, liquidity, and a more mature structure. Heading into 2026, the opportunity set remains strong, but the advantage will increasingly shift to buyers and investors who understand micro-markets, track supply concentrations, and choose assets based on fundamentals rather than hype.