Dubai Real Estate Market to Attract More FDI in 2025

Dubai continues to cement its reputation as a global real estate investment hub, with the market showing strong momentum and robust fundamentals heading into 2025. According to the latest figures, the UAE attracted Dh52.3 billion (approximately $14.2 billion) in total foreign direct investment (FDI) in 2024, with real estate accounting for 14% — nearly $2 billion. This growing trend underscores the confidence that global investors have in Dubai’s property sector, supported by progressive government policies and strategic urban development plans.

The Dubai Real Estate Strategy 2033, which aims to enhance transparency and investor trust, is one of the most significant frameworks boosting market confidence. It aligns with other initiatives such as the long-term Golden Visa, zero income tax, and an efficient property registration system. As a result, Dubai remains a preferred destination for international buyers and institutional investors alike.

In 2024 alone, the property sector witnessed 217,000 real estate investments totaling Dh526 billion. These figures include 110,000 new investors, reflecting a 55% surge compared to previous years. Looking ahead, 2025 is expected to deliver 182,000 new housing units, fueled by large-scale sustainable developments like Dubai South and Dubai Creek Harbour, which are set to keep this upward trajectory intact.

Shifting Buyer Demographics and Long-Term Value

One of the more interesting trends in Dubai’s property sector is the shift from speculative buying to end-user and institutional investor purchases. According to Eng. Amer Khansaheb, CEO of Union Properties, real estate transactions across five Emirates exceeded Dh239 billion in Q1 2025 alone — a signal of resilience and market maturity.

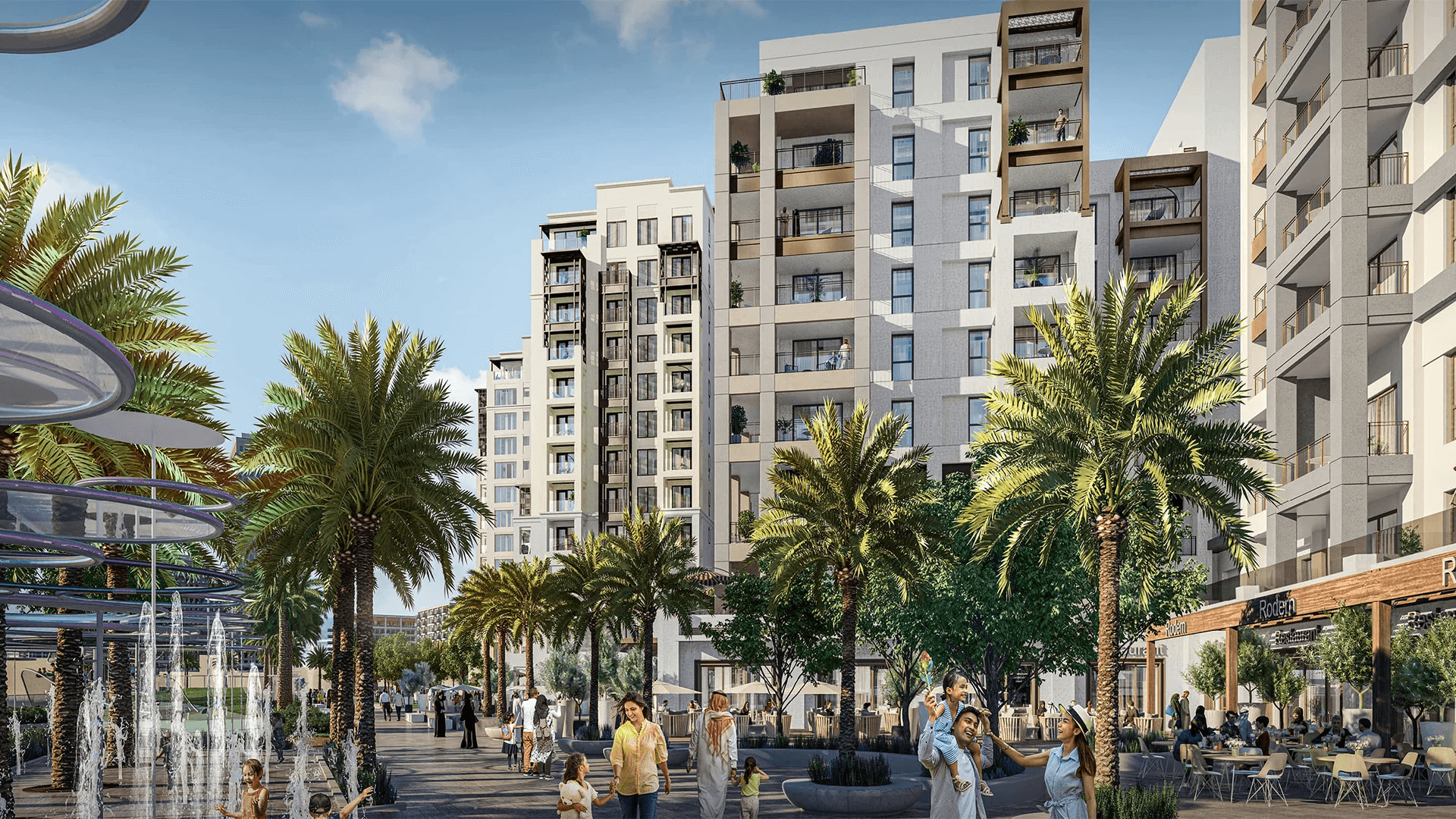

This transformation is pushing developers to prioritize integrated, mixed-use communities that offer long-term value. In key areas like Dubai Marina, Business Bay, and Jumeirah Village Circle, demand is high for well-connected, community-oriented, and amenity-rich developments.

Infrastructure as a Growth Catalyst

Infrastructure enhancements are also playing a vital role in shaping market dynamics. The new Blue Line Metro extension has already resulted in an average 23% rental increase across the nine connected communities. Transit-oriented development is now a key investment strategy, influencing both residential and commercial demand. Developers like Emaar and Damac are leveraging this by launching projects near key metro routes and transportation corridors.

A Healthy Market Correction

Despite strong performance, the Dubai real estate market has shown signs of healthy stabilization. According to Property Monitor, prices dipped by 0.57% in January 2025 — the first decline since mid-2022. This correction indicates better alignment between supply and demand and opens new opportunities for buyers seeking value-driven investments.

Challenges and Opportunities in Mid-Income Housing

While the luxury segment continues to thrive, mid-income housing remains a critical challenge. High down payments, stringent loan-to-value (LTV) ratios, and a limited range of financing options are major hurdles for many residents transitioning from renting to ownership.

To bridge this gap, developers are introducing innovative financing models. Union Properties, for instance, is offering a 60/40 payment plan in its Motor City project. Other developers such as Samana are exploring similar flexible payment structures to attract salaried expats and long-term residents.

Outlook for 2025 and Beyond

According to Mario Volpi, Head of Brokerage at NOVVI Properties, the second half of 2025 is expected to maintain a strong growth trajectory. New product launches, a maturing investor base, and sustainable building initiatives will continue to drive the market. Investors are also leaning towards ready-to-move-in units due to rising rents in the rental market.

The UAE’s appeal is further strengthened by factors such as political stability, evolving visa regulations, tax efficiency, and its strategic location. As developers focus on delivering high-quality, well-located, and thoughtfully planned communities, Dubai will remain a low-risk, high-return investment market for the foreseeable future.

In summary, the Dubai real estate market in 2025 presents a unique mix of maturity and innovation. From infrastructure growth and policy reforms to shifting investor behavior and financial accessibility, all signals point to a resilient market poised for long-term gains.