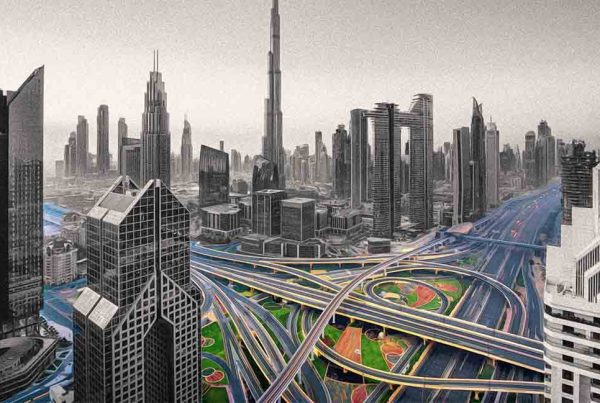

GCC Equity Markets Attract $4.2 Billion in Foreign Inflows: Dubai and UAE Stand Strong

The Gulf Cooperation Council (GCC) equity markets defied geopolitical and economic headwinds in Q2 2025, attracting a record $4.2 billion in foreign inflows—the highest since Q4 2022. Despite regional tensions and global trade concerns, international investors continue to view the GCC, particularly the UAE and Saudi Arabia, as resilient safe havens for capital deployment. Dubai’s financial strength and its robust real estate market further amplify the emirate’s appeal in the eyes of global investors.

Resilience Amid Geopolitical Risks

The report by Iridium Advisors highlighted how GCC inflows surged despite heightened geopolitical risks, including the Israel–Iran conflict and a missile strike on Qatar. Such events fueled volatility in oil prices and created broader uncertainty. Yet, investors displayed confidence in the region’s fundamentals, underpinned by strong balance sheets, fiscal reforms, and ongoing economic diversification. This resilience underscores Dubai and the UAE’s growing status as safe investment hubs, offering both equity and real estate opportunities.

Breakdown of Foreign Inflows

In June 2025 alone, the GCC attracted $2.4 billion in foreign investments. Saudi Arabia led with inflows of $971 million, followed closely by the UAE at $840 million. Kuwait and Qatar contributed $375 million and $219 million, respectively. Kuwait, in particular, extended its streak to 12 consecutive months of inflows, the longest in the GCC, demonstrating sustained foreign appetite for the country’s equities.

These figures not only highlight the appeal of individual GCC markets but also signal growing investor trust in the region’s economic trajectory. For Dubai, this influx aligns with the strong performance of developers such as Emaar, DAMAC, and Sobha Realty, whose projects continue to attract foreign capital across premium and mid-range real estate segments.

Global Trade Concerns and Tariff Risks

Despite these record inflows, risks remain on the horizon. Discussions in Washington around reciprocal tariffs could slow global trade and impact GCC exports. Oil price fluctuations—already heightened by regional conflicts—remain another wild card. While these external risks are noteworthy, Dubai’s diversified economy, supported by tourism, real estate, and technology, helps buffer against global shocks.

Investors are closely monitoring these developments while continuing to channel funds into Dubai’s prime property zones like Palm Jumeirah, where luxury real estate maintains strong capital appreciation.

Equities and Real Estate: A Dual Attraction

While equity markets capture the spotlight for quarterly inflows, Dubai’s real estate market provides an equally attractive destination for international investors. Rental yields remain strong, often ranging between 6–8%, while capital values in prime areas like Downtown Dubai and Dubai Marina continue to climb. The alignment of financial market resilience with real estate strength positions Dubai as a holistic investment ecosystem.

For foreign investors, this means exposure not only to profitable equities but also to high-performing property assets developed by industry leaders like Emaar and DAMAC. This dual opportunity has fueled global inflows into both listed companies and physical property assets.

Investor Confidence Ahead of Q3 2025

Heading into the third quarter, investor sentiment remains constructive. The GCC’s fundamentals, combined with proactive government reforms, suggest sustained capital inflows. Still, analysts warn that companies must maintain transparent disclosure practices and proactive investor relations to safeguard trust, especially amid potential global trade headwinds.

Dubai, with its favorable tax regime, strategic location, and expanding infrastructure, is particularly well-positioned. Whether through equities or property investment in destinations such as Jumeirah Village Circle or iconic luxury zones like Palm Jumeirah, the city continues to prove itself a global magnet for capital.

Conclusion

The record $4.2 billion in foreign inflows into GCC equities in Q2 2025 highlights a region of remarkable resilience, where Dubai stands out as a focal point. Despite global uncertainties and regional challenges, foreign investors remain confident in the UAE’s economic stability and growth prospects. With thriving equities and a booming real estate market, Dubai is reinforcing its reputation as a global financial and investment hub.