Dubai Islands: The Northern Waterfront Transforming Dubai Real Estate Market

Dubai property market has long been defined by visionary projects, from the record-breaking Palm Jumeirah to world-famous hubs like Downtown Dubai. In 2025, the spotlight is shifting to Dubai Islands, a new waterfront development poised to redefine the northern corridor of the city. With sales already surpassing AED 3.5 billion in the first half of the year and Nakheel spearheading ambitious infrastructure plans, this community is being called Dubai’s next big milestone.

Executive Snapshot

- H1 2025 Sales Volume: AED 3.5 billion

- May 2025 Alone: AED 950+ million

- Projected Capital Growth (2025–2028): 25–35%

- Rental Yields: 6–8% (apartments), 4–6% (villas)

Backed by Nakheel, the master developer of Palm Jumeirah, Dubai Islands is strategically placed between Deira, Dubai International Airport, and the central city, blending cultural heritage with prime connectivity and stunning Arabian Gulf views.

Why Dubai Islands Is Outperforming in 2025

1. Sales Momentum That Rivals Palm Jumeirah

In just six months, Dubai Islands achieved AED 3.5 billion in transactions — numbers that took Palm Jumeirah years to reach. This indicates a maturing real estate ecosystem and pent-up demand for new waterfront inventory.

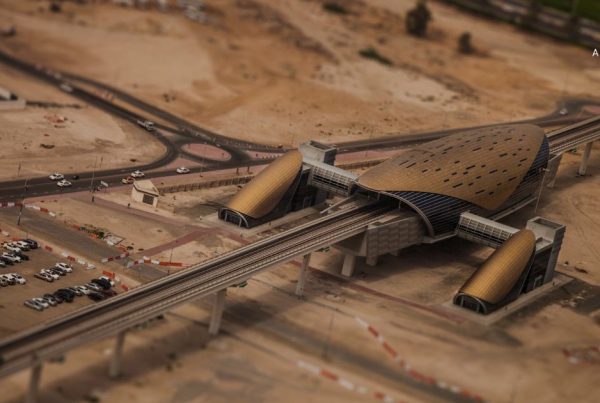

2. Strategic Location: The Northern Gateway

Dubai Islands connects seamlessly with historic Deira, Dubai Creek, and Dubai International Airport. Planned road expansions and transport links will improve accessibility, making it a highly convenient location compared to other emerging hubs like Dubai Creek Harbour.

3. Diverse Investment Segments

The community appeals to a wide spectrum of buyers:

- Ultra-Luxury Villas: Priced from AED 8M–40M+, offering private beachfront living.

- Branded Residences: Ranging AED 3M–15M, managed by global hospitality brands.

- Lifestyle Apartments: AED 1.5M–5M, mid-market homes in walkable mixed-use districts.

4. Flexible Developer Payment Plans

Options such as 50/50 and 60/40 payment structures reduce upfront pressure and open access for both international and local buyers.

Dubai Islands vs Other Key Hubs

| Development | Advantages | Limitations | Investment Grade |

|---|---|---|---|

| Palm Jumeirah | Global brand, proven luxury hub | Limited new supply, high entry costs | A+ (Mature) |

| Dubai Creek Harbour | Iconic skyline, central location | Less beachfront lifestyle | A- (Developing) |

| Dubai Islands | Fresh inventory, prime northern location, diverse pricing | Construction phase, market still stabilizing | A (Emerging) |

Financial Performance & Projections

Based on historical trends, Dubai Islands shows strong growth potential:

- Palm Jumeirah (2020–2025): 20–30% capital appreciation

- Dubai Creek Harbour (2022–2025): 15–25% growth

- Dubai Marina / JBR (2020–2025): 10–20% growth

- Dubai Islands (2025–2028 Outlook): 25–35% capital appreciation

Rental yields are projected at 6–8% for apartments and 4–6% for villas, with short-term rentals benefiting further once hospitality projects and resorts open.

Risks and Considerations

- Construction Timelines: Handovers are phased; while Nakheel’s track record is strong, delays remain possible.

- Premium Pricing: Prices per square foot are already 15–20% above mainland Deira, reflecting waterfront exclusivity.

- Liquidity Risks: Ultra-luxury villas may take longer to resell, while mid-market apartments offer easier liquidity.

Who Should Invest?

Dubai Islands offers opportunities for various investor profiles:

- Portfolio Diversifiers: Owners of Palm Jumeirah or Creek Harbour properties seeking northern exposure.

- Yield Hunters: Investors targeting branded residences with strong rental demand.

- Capital Growth Investors: Long-term buyers focusing on villa plots and exclusive assets.

- End-Users: Families upgrading to lifestyle apartments in a vibrant, community-driven location.

2025–2028 Investment Strategy

Immediate (Q3–Q4 2025): Secure villa plots and branded residences during pre-launch phases.

Medium-Term (2026–2028): Capitalize on infrastructure completion and rising tourism demand.

Optimal Entry Window: From now until Q1 2026, when construction progress is visible but pricing remains pre-handover.

Conclusion: Dubai’s Northern Opportunity

Dubai Islands is more than an off-plan community — it is a transformative development shaping the city’s northern coastline. With Nakheel’s expertise, robust sales momentum, and significant projected growth, it represents both a lucrative investment opportunity and a lifestyle upgrade. For those seeking early-stage value with long-term upside, the time to act is now.

Explore more communities like Jumeirah Beach Residence or Dubai South, but keep Dubai Islands firmly in focus — it may well be the city’s next Palm Jumeirah moment.