Dubai Ultra-Luxury Real Estate Shortage: A Hidden Investment Opportunity

Dubai has emerged as a top-tier destination for ultra-luxury property investments. Its architecture, hospitality, and lifestyle offerings have transformed the city into a global luxury hub. Yet a key market dynamic is amplifying this trend: a fast-approaching shortage in branded and ultra-luxury homes. For investors, this signals a limited-time opportunity to capture premium capital gains before the supply gap deepens.

According to DXBinteract data, over 326,000 units are currently under construction in Dubai. However, only 16,500 units are considered luxury or ultra-luxury — and just 3,400 of those fall into the ultra-luxury bracket. Most are still in the early stages of construction, with under 20% progress. This means very few will be handed over before 2026.

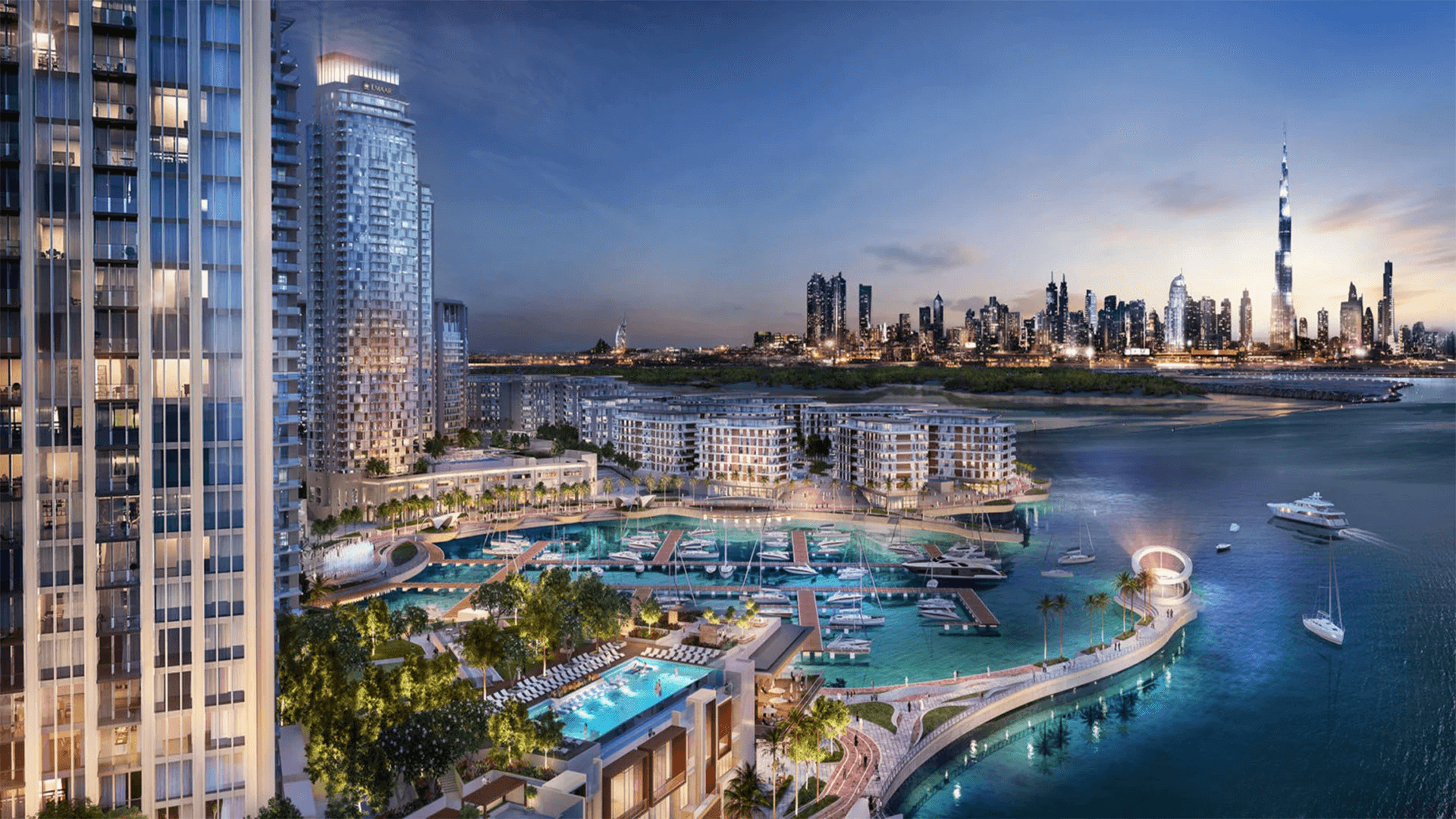

Aurantius Real Estate offers exclusive access to many of these rare properties, helping investors secure future gold in prime locations like Palm Jumeirah, Emaar Beachfront, and Downtown Dubai.

The Timeline: 2026 and Beyond

Flagship ultra-luxury projects like Bugatti Residences, Armani Beach Residences, Cavalli Couture, and Baccarat are expected to complete between 2026–2027. While these units will be ready for occupancy, the number of new launches after 2026 is expected to decline significantly. This creates a rare demand-supply imbalance in the high-end segment.

DXBinteract’s pipeline data supports this trend:

- 2024: ~27,000 units (luxury share 8%)

- 2025: ~41,000 units (luxury share 9%)

- 2026: ~42,000 units (luxury share 10%)

- 2027: ~19,000 units (luxury share 7%)

- 2028: ~5,000 units (luxury share 5%)

- 2029: ~1,000 units (luxury share <1%)

Why Branded Residences Outperform

Branded residences — developed in partnership with luxury fashion or hospitality brands — consistently outperform traditional projects. They offer unmatched value through services like hotel-style living, concierge management, and globally recognized design and security standards.

According to global property reports, branded residences enjoy a 30–45% premium over non-branded properties. In Dubai, early investors in developments like Emaar‘s Armani Residences and Omniyat‘s Dorchester Collection have recorded over 40% capital appreciation.

Strategic Developer Partnerships

Key developers like Deyaar, Irth Development, Bentley Home, and One Development are pushing boundaries with sophisticated designs that cater to HNWIs. In areas like Jumeirah Bay Island, Dubai Marina, and Business Bay, these branded residences are setting new benchmarks.

Investor Insights: Capitalizing on Scarcity

Investor Insights: Capitalizing on Scarcity

As fewer ultra-luxury properties are introduced post-2026, those available today are poised for appreciation. The rare nature of branded inventory, coupled with growing HNWI demand, positions these units as future blue-chip assets. Investors entering now can benefit from:

- Early entry pricing

- Long-term capital appreciation

- Premium resale value in limited inventory environments

Investment Strategy for 2025

To maximize value, investors should:

- Target off-plan launches by trusted luxury developers

- Secure projects with handovers in 2026–2027

- Focus on lifestyle-driven areas with low current supply

Tourism is back on the rise, especially in places like Dubai Marina. Short-term rentals and branded residences are creating room for consultants who understand market segmentation, local laws, and yield maximization. This sector is particularly attractive for real estate experts collaborating with developers like Samana.

Locations such as Al Furjan, Jumeirah Village Circle, and Meydan offer a balance of growth potential and lifestyle appeal. Developers like Samana Developer, DAMAC, and Select Group continue to deliver luxury experiences to meet rising expectations.

Final Thoughts

The ultra-luxury shortage in Dubai is more than a statistic — it’s a strategic signal for investors. Those who act now in the branded segment stand to benefit from appreciation, prestige, and limited future competition. With the pipeline thinning after 2026, now is the time to secure your place in Dubai’s high-end property future. Explore opportunities with Aurantius and gain early access to the city’s most prestigious addresses.

Investors are advised to diversify across different property segments and areas. Developers like DAMAC, Ahmadyar, and Peace Homes Group are delivering value-driven units in locations such as Dubai Production City, Al Furjan, and Dubai Studio City.

Moreover, areas like Dubai Creek Harbour, Dubai Hills Estate, and Al Furjan are witnessing increased demand due to their strategic locations and developer-backed payment plans, appealing especially to first-time homebuyers and families relocating to the UAE.