Dubai Property Market: Why a 10–15% Price Dip Signals a Healthy Correction, Not a Crisis

Analysts expect Dubai’s real estate market to cool modestly after four years of rapid expansion, with Fitch projecting a measured correction rather than a meltdown. For investors, homeowners, and tenants alike, a 10–15% dip is best viewed as the market catching its breath after a post-pandemic surge, not a warning sign of structural weakness. This kind of reset historically improves affordability, widens the buyer pool, and lays the groundwork for the next sustainable growth phase.

Fitch’s View: A Soft Landing After a Powerful Run

Since 2020, Dubai home values have climbed sharply, supported by investor-friendly policies, long-term residency options, and a record influx of global capital. Fitch’s outlook frames the coming period as a “soft” decline—an orderly rebalancing after outsized gains, especially in premium villa and waterfront submarkets where prices in select communities jumped 30–50%. In practical terms, a controlled easing tends to normalize absorption, cool bidding frenzies, and reduce the risk of speculative excess.

What Drove Prices So High—So Fast?

The COVID recovery catalyzed a structural re-rating of Dubai as a safe, open, and efficient hub. Capital flowed in from Europe, Russia, India, and China; entrepreneurs and remote professionals arrived under flexible visa regimes; and top-end buyers targeted turnkey luxury inventory. That cocktail produced a classic demand–supply imbalance, particularly across trophy assets and prime villa stock. Limited, high-spec supply met surging global demand—and prices responded accordingly.

Why a 15% Dip Can Be Good News

Healthy markets breathe. A 10–15% cooling can stabilize headline prices, restore affordability for middle-income buyers, and align resale expectations with actual end-user demand. Crucially, this phase differs from past downturns: developers today are phasing launches, using escrow safeguards, and focusing on user-centric product, which mitigates oversupply risk. A modest reset also narrows the gap between asking and achieved prices, improving transaction efficiency and financing confidence.

Comparing to Mature Global Gateways

Dubai remains more dynamic—and therefore more price-elastic—than older, supply-constrained hubs like London or Singapore. Faster growth spurts often come with quicker corrections. The difference in 2025 is policy maturity and market plumbing: improved transparency, digital conveyancing, escrow discipline, and strong developer governance have raised the market’s floor. That’s why a correction today looks more like normalization than distress.

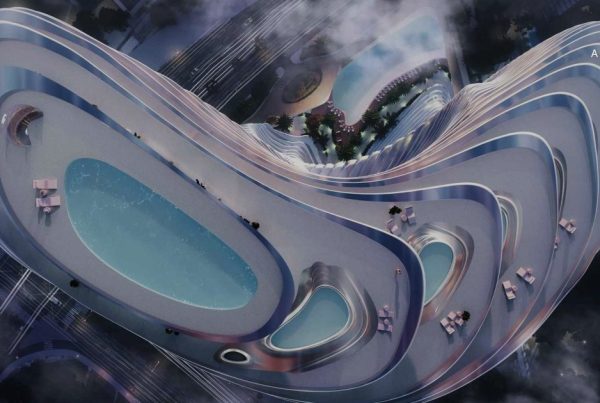

Luxury Still Has Legs—But Selectivity Matters

Even as headline prices cool, demand at the very top end remains resilient. Ultra-high-net-worth buyers continue to favor limited-supply, globally recognized postcodes, where brand cachet and scarcity underpin values. In Dubai, that typically includes addressable micro-markets linked to world-class amenities and waterfront frontage. If you’re benchmarking prime demand and long-term liquidity, start with proven cores such as Palm Jumeirah and Downtown, then widen the lens to lifestyle-led districts like Jumeirah for villa-centric family living.

Actionable Playbook for Buyers and Investors

Prioritize fundamentals over fear. Corrections reward disciplined underwriting. Stress-test rent assumptions, service charges, and finance costs; favor efficient layouts and buildings with strong owners’ associations.

Lean into developer quality. In cooler markets, pedigree matters more. Benchmark upcoming and completed projects by established names like Emaar, DAMAC, and Sobha Group to anchor risk and enhance resale depth.

Balance income and growth. If your strategy is yield-first, target mid-market communities with deep tenant pools; if you’re anchoring long-term capital, a blue-chip address with scarcity value can justify thinner yields. Many outperforming portfolios blend one of each.

Use the window to negotiate. In a cooling phase, motivated sellers and developers may offer better terms—closing cost support, post-handover plans, or upgrade packages—without compromising asset quality.

What Sellers Should Do in a Cooling Cycle

Price to today’s comps, not last quarter’s headlines. Make homes “turnkey” with snag fixes and upgraded appliances to differentiate in a more selective market. If timelines are flexible, consider leasing to preserve optionality while capturing income. Above all, partner with brokers who understand micro-market velocity and can position your property against realistic buyer expectations.

Signals to Watch in the Next 6–12 Months

Monitor new supply timing, especially in mid-market towers and townhouses; watch mortgage rate trends and bank appetite; track time-on-market and price-cut frequency; and follow launch absorption for top developers like Emaar, DAMAC, and Sobha Group. In parallel, keep an eye on leasing demand across resilient rental hubs such as Downtown, family-oriented enclaves like Jumeirah, and trophy waterfronts on Palm Jumeirah.

Bottom Line: A Pause—Not a Panic

The anticipated 10–15% price dip is a classic mid-cycle reset, not a crisis. It relieves pressure, restores affordability, and curbs speculation—all hallmarks of a maturing market. For long-term investors, this is often when risk-adjusted opportunities surface: quality assets at more rational pricing, better terms from serious sellers, and improved selection without bidding wars. Anchor decisions in data, favor proven locations and developers, and let the market’s breath become your entry signal—not your exit cue.