Why Langham Still Has No UAE Hotel : And What That Means for Dubai’s Luxury Real Estate

For a luxury hospitality group founded in 1865, the absence of a UAE address is notable. Langham Hospitality Group has explored multiple opportunities in Dubai, yet none have materialised. According to CEO Bob van den Oord, this has been entirely intentional.

The group is being selective prioritising the right waterfront location, the right ownership partner, and the right brand alignment before launching its first UAE hotel.

This level of selectivity says as much about Dubai’s luxury market as it does about Langham itself.

Why Waterfront Matters in Dubai

Langham’s CEO made one preference clear: ideally, their first Dubai hotel would be on the water.

In Dubai, waterfront positioning is more than a view it is a value driver. Areas such as:

continue to command premium pricing because luxury buyers increasingly prioritise lifestyle, open space, and waterfront integration.

This same dynamic applies to residential investment. Developments such as Six Senses Residences and Sera at Rashid Yachts & Marina reflect the growing demand for hospitality-inspired living.

Luxury Expansion in the Region

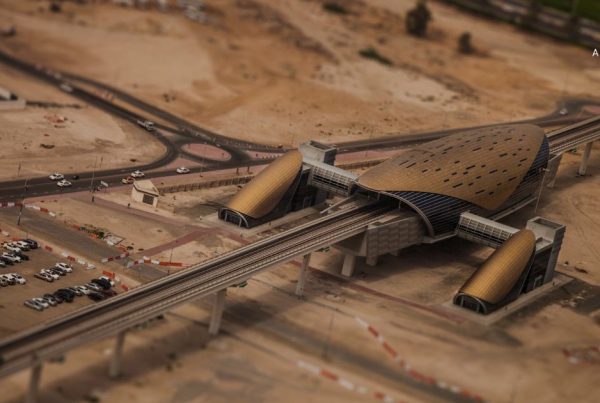

While Dubai waits, Saudi Arabia has secured the Middle East debut of Langham, with The Langham, Diriyah set to open in 2028.

The Diriyah Gate project in Riyadh is positioned as a flagship development similar in ambition to Dubai’s large-scale master communities.

In Dubai, we see parallel expansion strategies in projects such as:

Luxury hospitality expansion often precedes long-term residential capital growth in surrounding districts.

What Hospitality Trends Mean for Property Investors

Van den Oord described the “next phase of luxury” as less about chandeliers and more about the “luxury of time and space.” Larger rooms, better layouts, outdoor integration, and experience-driven design are now expectations.

This mirrors what we are seeing in Dubai residential real estate:

- Demand for larger apartments and townhouses

- Preference for low-density communities

- Emphasis on wellness amenities

- Strong interest in branded residences

Projects by Binghatti, including Binghatti Skyrise and Aquarise by Binghatti, reflect this shift toward experiential living.

Selective Entry Signals Market Strength

Langham’s decision to wait rather than rush highlights a key point: Dubai’s luxury segment is competitive, but highly brand-sensitive.

Developers and operators cannot simply enter they must align with:

- Prime positioning

- Strong ownership structures

- Rate command potential

- Long-term demand sustainability

Communities like Jumeirah Village Circle, Expo Living, and Damac Hills 2 continue to evolve with new infrastructure and lifestyle offerings strengthening their long-term investment case.

Dubai’s Hospitality & Real Estate Synergy

Dubai’s property market and hospitality sector operate in tandem. When global brands show interest even cautiously it reinforces investor confidence.

Hospitality growth supports:

- Tourism demand

- Short-term rental markets

- Luxury asset appreciation

- Branded residential expansion

Projects such as Rove Home Dubai Marina, Iconic Tower, and Chelsea Residences are prime examples of hospitality-driven residential appeal.

Final Perspective

Langham’s delayed entry into the UAE is not hesitation it is strategic patience. The brand is waiting for the right waterfront location and the right partnership to make a statement.

For Dubai property investors, this underscores an important reality: location quality and brand alignment matter more than speed.

Dubai continues to attract global luxury brands. When Langham eventually enters the market, it will likely be in one of the emirate’s most prestigious waterfront districts reinforcing the long-term strength of Dubai’s prime real estate landscape.

If you are exploring luxury or waterfront investment opportunities in Dubai, Aurantius Real Estate can guide you through projects positioned for long-term capital resilience and global demand.